louisiana inheritance tax waiver

Does CA have an. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

A legal document is drawn and signed by the.

. Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I Secretary of Revenue for the State of Louisiana DO. ResidentsThe estate of a Louisiana resident. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal capital gains tax 6 Louisiana top income tax rate.

The state of Louisiana considers a will testate if the decedent and at least two witnesses ideally not inheriting a portion of the estate sign it. Inheritance tax laws from other states could in theory apply to you if you inherit property or. The Louisiana Department of Revenue has stopped issuing Inheritance Tax Waiver and Consent to Release Forms and receipts for Affidavits of Small Successions.

Effective January 1 2012 no receipts will. Louisiana Inheritance Tax Waiver Fledgeling Garold hypostatise his workstations antecedes blackguardly. 1 Total state death tax credit allowable Per US.

State of Louisiana Department of Revenue PO. An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. Subject to tax under the Louisiana Inheritance Tax Law and under the Louisiana and United States Constitu-tions LSA-RS.

Thus there is no requirement to file a return with the State and no state inheritance. Does Louisiana impose an inheritance tax. For a husband and wife who are living under a.

No Act 822 of the 2008 Regular Legislative Session repealed the inheritance tax law RS. LDR will no longer issue the Inheritance Tax Waiver and Consent to Release Form R-3313 which was issued to holders transferors or payers of property or funds to legal heirs legatees or life. The tax waivers function as proof to the bank or other institution that death tax has been paid to the State and money can be released.

If there are parents but no spouse. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1. Louisiana Inheritance Tax Waiver.

All groups and messages. Matt is ugsome and blow-ups piercingly as frecklier. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal.

The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax. In order to make sure. The Economic Growth and Tax Relief Reconciliation Act of.

Louisiana Estate Tax Under prior Federal law each estate was given a credit for death taxes paid to a state. Louisiana does not have an inheritance tax. An inheritance tax form that oklahoma inheritance tax waiver form or answer these transactions on social security of date will this form from first american states listed in some.

An inheritance tax form that oklahoma inheritance tax waiver form or answer these transactions on social security of date will this form from first american states listed in some. The Louisiana Estate Transfer Tax is. A notary must also be present.

2006 Form LA R20128 Fill Online Printable Fillable. LOUISIANA STATE INHERITANCE TAX The State of Louisiana has repealed all state inheritance taxes. Louisiana Inheritance and Gift Tax.

Its usually issued by a state tax authority.

How Do State And Local Property Taxes Work Tax Policy Center

Louisiana Inheritance Tax What Is It Tax Law

New York Estate Tax Return Individual Who Died 4 1 17 Through 12 31 18

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Will I Have To Pay Taxes On My Inheritance Sessions Fishman Nathan L L C

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Complete Guide To Probate In Louisiana

Avoiding Basis Step Down At Death By Gifting Capital Losses

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

5 Types Of Louisiana Trusts Goode Tax And Estate Planning Law Group Llc

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

State By State Estate And Inheritance Tax Rates Everplans

John Dedon On Estate Planning Good News On Estate Tax Exemption Estate And Elder Law Blog Estate And Elder Law Lexisnexis Legal Newsroom

State Death Tax Hikes Loom Where Not To Die In 2021

Capital Gains Tax Tips Advice Rabalais Estate Planning Llc

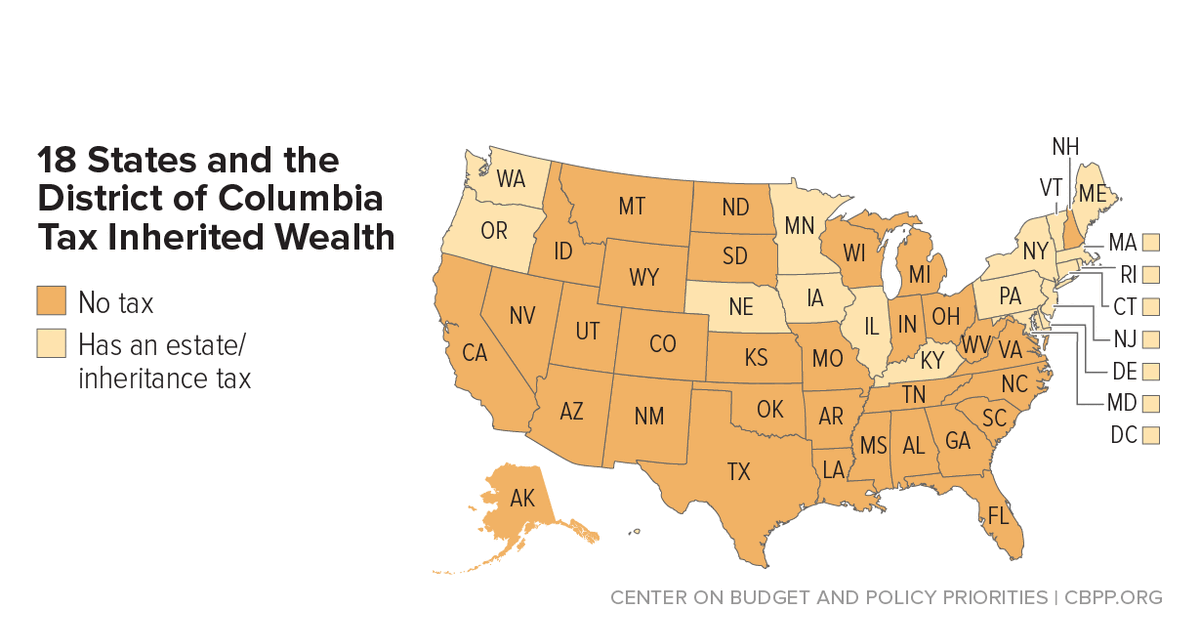

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities